FIMA US 2026

April 22 - 23, 2026

The Westin Copley Place, Boston, MA

Public Data, Private Challenge:

Uncovering the Implications of Public Data in KYC and Onboarding for the Buy Side & Sell Side

Table of Contents

The Moment in Time: Key Implications of Growing Public Data Usage

As nation states and international bodies seek to staunch the tide of money laundering, fraud, tax evasion and other concerns, firms are required to collect critical data on counterparties, often from registries or other sources independent of the counterparty itself. In this context, the ability to quickly and cost-effectively use public data to close key gaps in Know Your Customer (KYC) and reporting processes is invaluable. The USA’s Patriot Act and the European Union’s 4th Anti-Money Laundering Directive (AML4) offer examples of flagship regulatory frameworks that have established a high bar on due diligence and the collection and storage of information about the entities with whom a firm transacts.

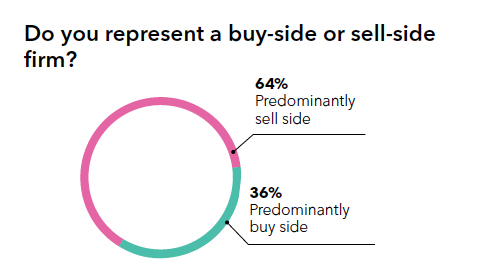

In order to gain a clearer understanding of how firms on the buy side and sell side use public data to meet challenges presented by KYC requirements and onboarding with multiple parties, Bloomberg and WBR Insights partnered to survey 279 executive members of the FIMA event database, with 100 representing the buy side and 179 contributing the perspective of the sell side of the financial industry.

The sell side’s relationship to public data is driven by the need to conduct thorough due diligence on the entities they do business with, while meeting stringent standards for compliance with regulations as well as internal policies on sourcing information. By contrast, the buy side uses public data as a means to learn more about the entities they do business with, as well as monitor the information in the public domain on their own firms—a critical concern given the potential impact to reputation, sustainability and growth.

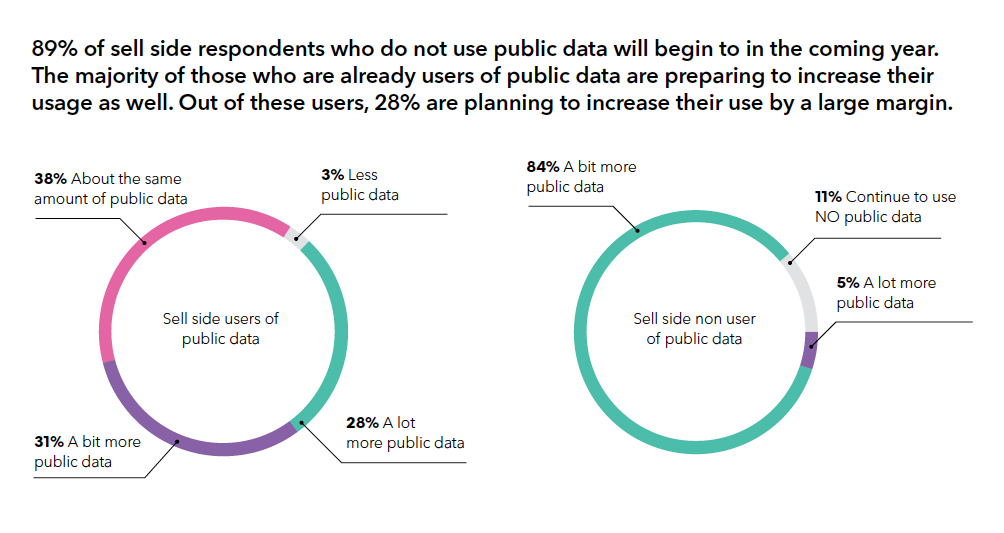

Based on public data’s benefits, the sell side is seeking to expand their usage of this data in their KYC and onboarding processes, even despite admitted challenges in managing increased volumes of data coming from disparate sources. Public data is set to become an important part of filling information gaps in material provided to them by private entities as the technology emerges to allow this data to be more fluidly obtained and documented in accordance with internal compliance and regulatory standards. This continued movement towards adoption reflects the fact that sell side entities by default require as much information as they can realistically obtain on the entities with whom they transact.

The most pressing takeaway for the buy side relates to the attention they pay to the public data available on their own firms. Of those who utilize public data, 43% will

update their firm’s own publicly available information for accuracy no more frequently than twice a year. As public data becomes an increasingly standard part of how the sell side performs due diligence for KYC and onboarding, the buy side must also be attentive to this trend, in particular around how the data available on their firms can effect perceptions of them and their business partners, in turn driving the need to actively monitor and update.

Over 60% of sell side public data users will use internet searches and social media when looking for data on their counterparties—the buy side cannot afford to ignore any of the information on their firms within the public sphere.

Featured Contributor

In addition to the benchmark data and analysis contained in this report, selected quotations provided by a subject matter expert have been used to add context and color to the statistical information within the document.

Quotes were contributed by:

Dan Matthies

Global Head of KYC Solutions

Bloomberg

Key Findings

KYC puts pressure on firms to obtain as much reliable information as possible. To that end, both sell side and buy side entities are seeking a broad range of public data sources to supplement the overall effectiveness of their onboarding, with critical implications for both sides.

The use of public data is widespread, with high adoption both within sell side and buy side firms. Though exactly how they utilize public data differs, both sides of the industry report consuming public data from diverse sources including public news, internet search results, and social media, though the data that they truly trust tends to come from government resources, regulatory databases, subscription databases and premium news sources. Along with this widespread use comes the need to address what that means for each side of the industry.

For 82% of the sell side and 68% of the buy side, using public data saves time, money or both.

Despite challenges related to its documentation, public data is a time and money saver for both the sell side and the buy side during their reporting and due diligence processes. This goes far to demonstrate the value of bringing reliable public data sources into KYC processes and due diligence, provided that firms are able to gather the proper provenance information and document it in a reliable and scalable way, which is where the majority have been experiencing challenges. Those who are able to streamline their consumption of public data and organize it in a usable way stand to gain a significant advantage.

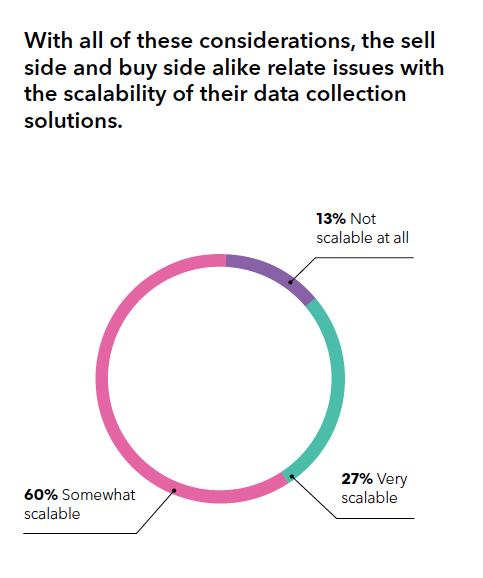

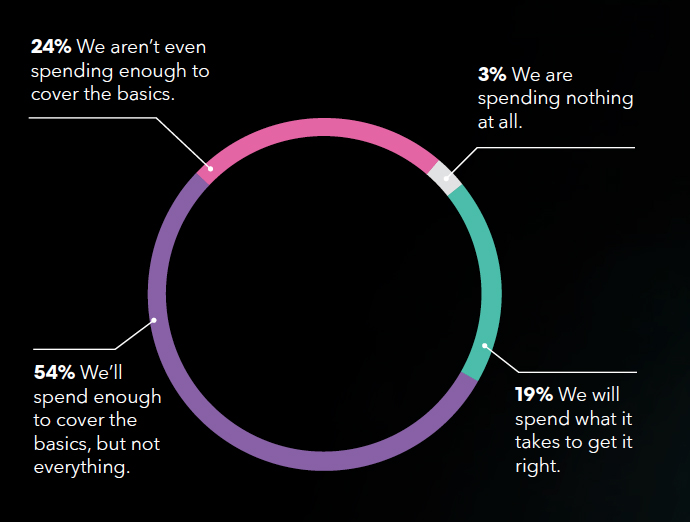

Ultimately, a collective 73% of all survey respondents are willing to increase their spending to work towards a stronger approach to data management.

Nearly three-quarters of the industry are awake to the fact that investments in data management tools are key to the development of a scalable, holistic approach to KYC and due diligence processes. They require tools that can help build automation into their workflows, draw from high-quality data sources, and bridge gaps in information quickly and seamlessly.

Research Analysis

Understanding how sell side and buy side use public data today

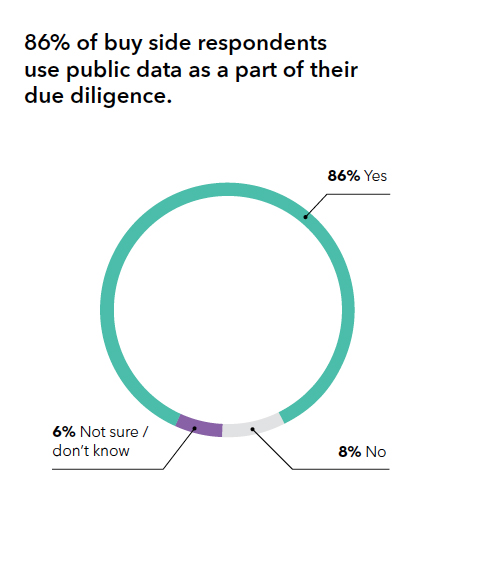

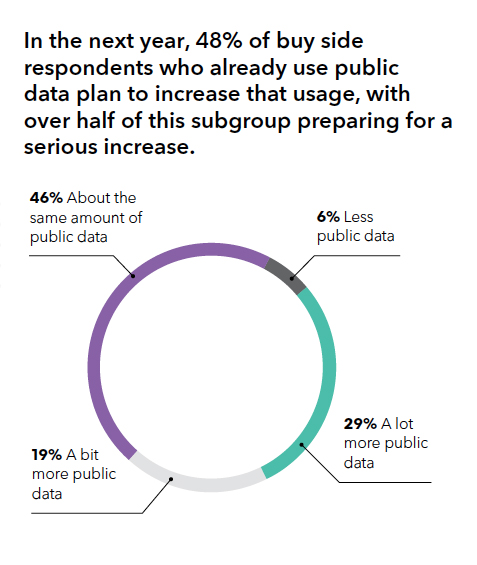

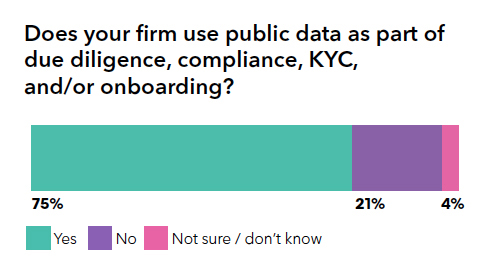

Public data is already in wide use within both sell side and buy side firms, with 75% of sell side and 86% of buy side respondents stating that they use it for their respective due diligence processes. By using public data that they find trustworthy to fill information gaps on their counterparties, both buy side and sell side firms are able to fill in critical missing details in a cost- and time-effective manner.

Public data’s importance in filling information gaps is evident when looking at how the sell side plans to increase its usage. Whether or not sell side respondents are currently using public data, virtually all will have begun to use at least some public data within their due diligence, compliance, KYC or other onboarding processes within the next year. This continued movement towards adoption

reflects the fact that sell side entities by default require as much information as they can realistically obtain on the entities that they do business with, something that KYC only heightens.

Even in the face of data management challenges, the sell side’s interest in public data adoption is manifest.

It makes sense that the sell side is a littler further ahead of the buy side with the use of public data because due diligence on their counterparties and customers is a key part of their business process. They need to collect information from counterparties directly, but they also need to get information from other publicly available sources—either as an alternative or a verification of the counterparty’s information. The sell side is much more focused on this as being part of their core operational process because, ultimately, that’s what KYC compliance regulation is trying to instill in them—good business practices in conducting due diligence.

Dan Matthies, Global Head of KYC Solutions at Bloomberg

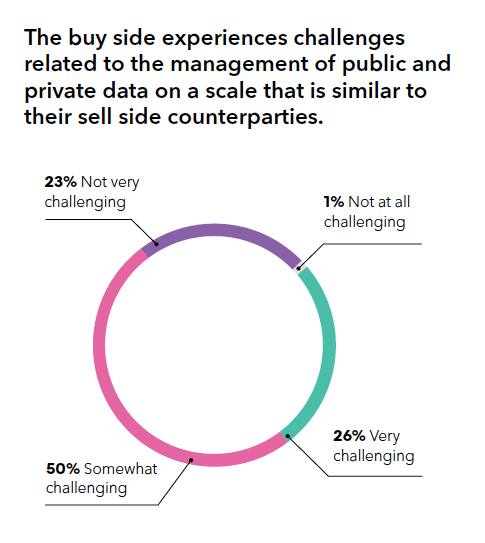

The buy side’s relationship with public data is not driven by the same pressures that face the sell side, but the usage of public data remains widespread based on its utility and their own needs for reporting and due diligence activities. Buy side firms are likely to use public data as a way to gain more information about the entities they are doing business with and understand what potential lies within their relationships. This includes searching for reputational risks posed by third parties to their organizations. They will also search for the information appearing on their firm that is freely available in the public domain, or through subscriptions or other premium services. Compared to the sell side, the need to comply with regulations for record retention around the public data they are viewing is less prevalent, making it somewhat easier for them to manage predominantly digital records, as well as develop a relationship with social data where an update relevant to the firm or a business partner can be followed up by visiting more trusted sources of information.

One of the key implications of sell side reliance on pubic data to complete due diligence on buy side counterparts is that buy side firms need to be increasingly attentive to their pubic profile, as this is increasingly relied upon by sell side entities in making business determinations. Sell side firms that don’t yet avail themselves of data from public sources should understand that public data represents a serious source of utility that their peers are likely already attuned to.

Common limitations on public data use

The need for high-quality, verifiable data sources is paramount for both sides of the industry. Sell side firms face challenging internal and external requirements on record retention and the verification of the sources of data that they use in their KYC and onboarding processes. Likewise, while facing fewer specific limitations, members of the buy side also have defined ideas of what types of public data they believe should be considered reliable sources.

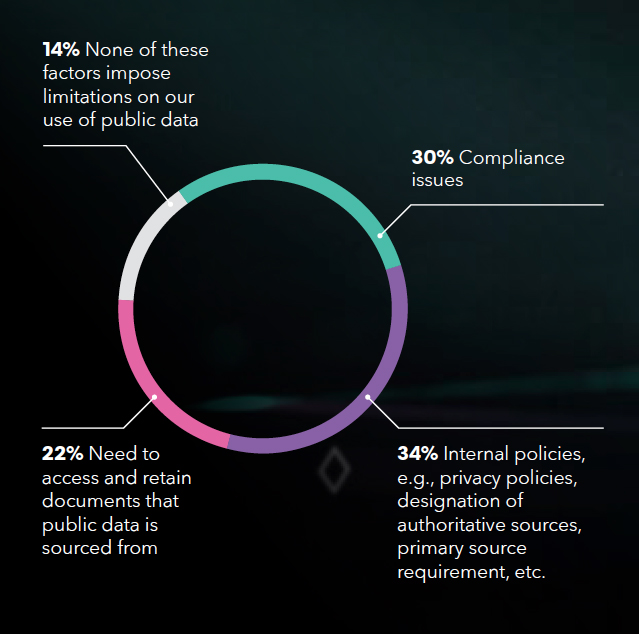

The limitations on the use of public data placed on sell side respondents are mostly a result of compliance challenges and their own internal policies.

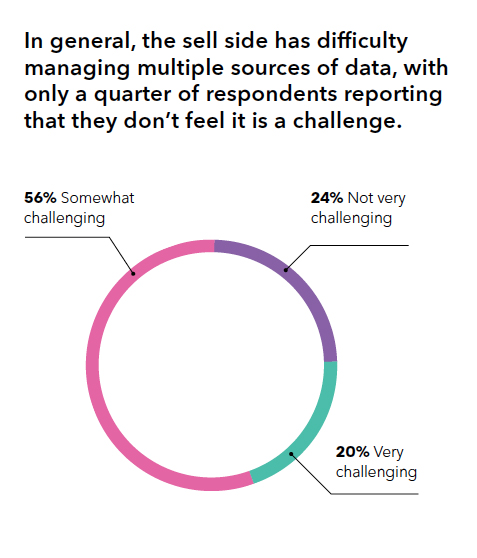

While 30% of sell side respondents point to issues with meeting compliance requirements as the most significant factor preventing them from using public data more freely, 34% are facing internal policy controls. Guidelines within their organizations dictate what can be considered authoritative, what proper sourcing protocols look like, and privacy policies that must be honored, putting certain information outside of the bounds of their proper due diligence activities. Another 22% felt that the need to source and retain records of the documents their public data was sourced from represented a significant limiting factor in public data use.

The difficult nature of reconciling data from multiple sources can be compounded by record retention mandates as well as whatever strictures for internal compliance might exist in the sell side environment, indicating that the sell side could benefit from a strong, holistic approach to meeting their KYC obligations that can bring in diverse sources of quality data.

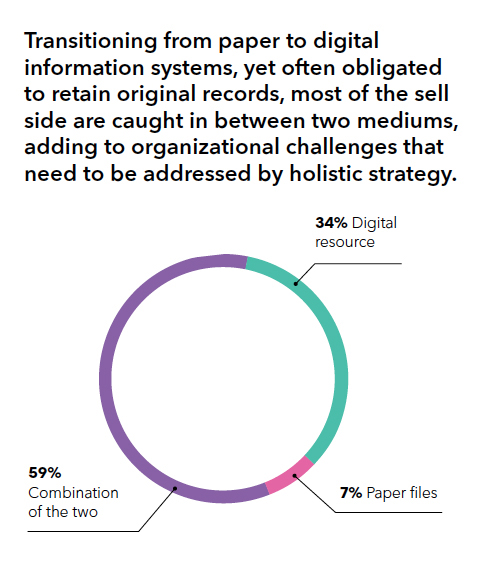

Unlike the sell side, 54% of buy side users of public data have been able to develop entirely digital frameworks for storing the results of their data collection.

Verification is a big issue. In the old days of data management, it was about getting data so you could build risk models and manage your business and operational risk. What KYC has brought to the table is to truly know your customer—and, by that, show you have the correct information about them in your systems. To do that, you need to have a policy which has very clear rules on what is acceptable information; for example, what are authoritative data sources, how often is the information reviewed and refreshed and how do you verify that it is accurate.

Dan Matthies, Global Head of KYC Solutions at Bloomberg

The problem you have when you’re getting data from multiple sources is that, once you get past retrieving data from the client to collecting it from the public sphere, how do you identify that you’ve found the entity you’re looking for?

Given the need to comply with record retention mandates, only 34% of sell side public data users are able to leverage entirely digital resources for storage of the results from their data collection. It’s much more common for them to have to reconcile paper and digital files, even in comparison to

their peers on the buy side, where 42% are in transition between digital and paper mediums.

In light of their commitments to growing their usage of public data, the fact that the majority of respondents using public data across both sides of the industry face scalability issues represents a potential for developmental challenges in the near future, and a lack of a single clear approach that accounts for all the steps related to sourcing and documenting counterparty information taken from the public domain.

Uniquely identifying the same entity from different sources is the big problem in entity data management. For example, when you’re looking for information on Hedge Fund “X” and you turn to multiple public sources to find fund formation information, how can you be sure that both sources refer to the same entity? There are numerous reasons why the same record may not have the same name, e.g., abbreviations, local language, translations, transliterations, prior names, trading as names, different naming conventions, etc.

Dan Matthies, Global Head of KYC Solutions at Bloomberg

Expanding the data used for KYC & compliance using trustworthy sources of information

In terms of public data consumption, the sell side is omnivorous while seeking out information during due diligence. They need all the data they can realistically obtain to meet their reporting obligations.

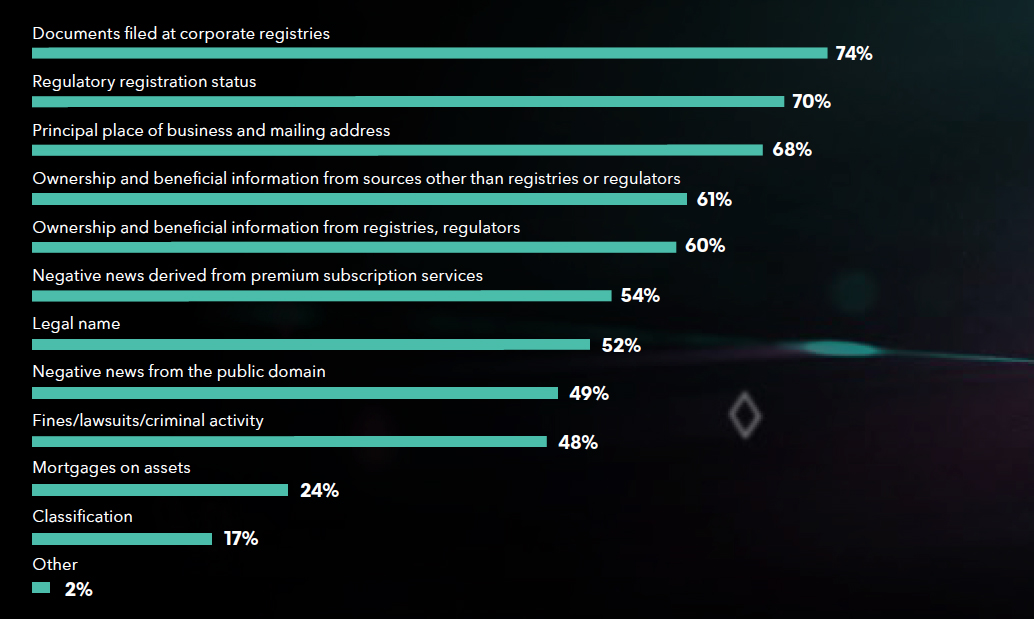

Sell side users of public data report that they access a broad range of data assets, with the most common being documents filed at corporate registries, regulatory registration status, and principal place of business and mailing address. What the

buy side should be particularly attentive to, however, is the fact that the majority of sell side firms will also seek out and consume negative news coverage derived from premium subscription services, and another 49% state that they will also look for negative news on entities from sources within the public domain. While a piece of negative coverage can vary greatly in impact depending on trustworthiness of the source, it’s important to note that all information related to an entity is likely to be viewed regardless.

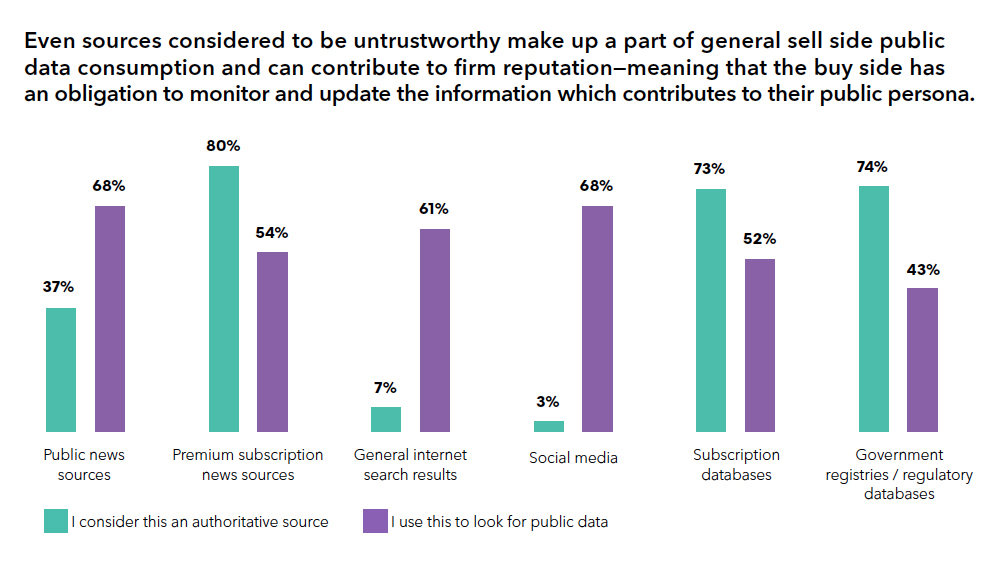

The public data that the sell side is willing to trust most often comes from premium subscription news sources, as well as subscription-based databases and government sources. The need to document and verify the sources of any

information they use plays a large part in this clearly established preference, as the nature of sources such as social media updates are hard to independently verify and can be ephemeral by nature.

For those on the buy side who assume that information outside of all but the most trusted sources of public data will go unseen, these results should serve as a wakeup call. The reality is that more sell side respondents will search for information on individuals and entities through social media, public news, and search engine results than those who will use a subscription database, by a margin of at least 9%.

The survey results indicate that when a firm pays for data from a vendor, they are relying on the quality of that vendor’s process in collecting that data, which is why 73% of respondents feel that subscription databases are trustworthy enough to use in their KYC and compliance processes, compared to the 3% who are willing to trust social media.

When a firm goes out and collects data itself, it needs to follow a documented policy and have clear standards. Just as important as getting the information is having a documented audit trail on how that information was collected. Having the source document is an important part of that process and is a major differentiator of a KYC compliance process from the data needs of managing a CRM system or building risk management models.

Dan Matthies, Global Head of KYC Solutions at Bloomberg

This laxity may come from a place where the buy side does not fully realize the impact of even noncredible sources of public information, such as social media, can have on their public persona. Effective management of public information needs to be taken seriously in the context of the voracious consumption of data among the sell side.

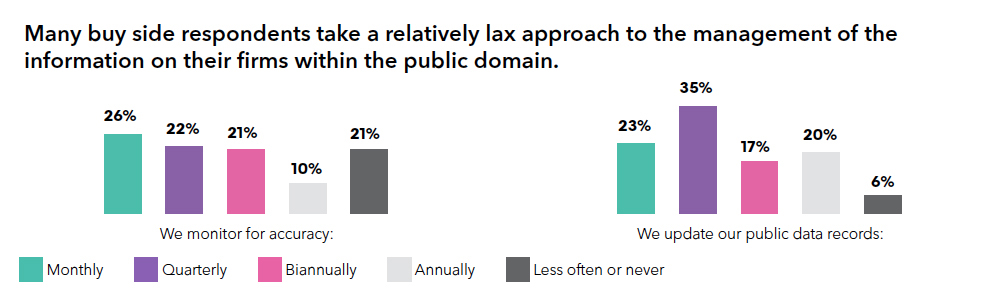

Only around one-in-four buy side users of public data will monitor and update their own public data records more frequently than once a month. It’s more common for the buy side to perform quarterly or biannual monitoring, assuming that they monitor their data for accuracy at all. While 58% of buy side public data users do update their firms’ public data records either monthly or quarterly, the fact remains that a large share will not update or verify this information more than once or twice in a year. In comparison, virtually all buy side non users of public data report that these areas are never looked at or updated, while their information may still be used by other entities to learn more about them.

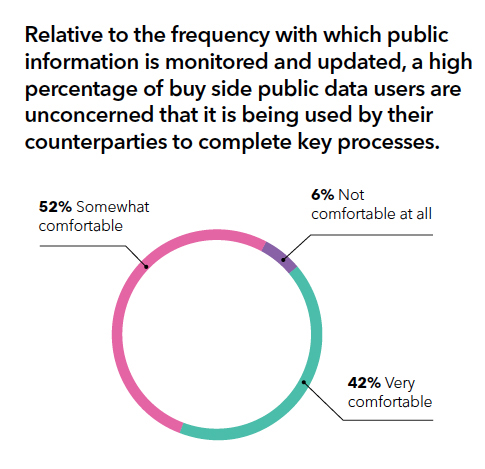

The typically low frequency that the buy side spends working with their own public data records stands in contrast to their comfort levels with knowing that their counterparties are using public data to complete Anti-Money Laundering (AML), KYC, suitability and other regulatory compliance processes. While the majority report less than a monthly frequency in both monitoring and updating the data available on their firms, 58% are either somewhat comfortable or not comfortable at all with the idea that these sources can form a significant part of the due diligence efforts their counterparties are performing on them.

With the amount of public data that the sell side is consuming, the buy side must be more attentive to the information that is available on their firms. Currently, the majority are not monitoring changes to the data that appears on their firms in the public domain any more frequently than once a month, if that.

Future snapshot: Investing in higher quality data and stronger controls

In order to develop more effective processes, 73% of all respondents are willing to start investing in better data quality and stronger management tools.

With the context of expanding public data usage, challenges with integration of data from multiple sources, and the need for documentation amongst large groups of both buy side and sell side respondents, it follows that the logical next step is investing in the tools that will allow them to comfortably scale the breadth and efficacy of their data collection for KYC, onboarding, and other due diligence processes using all available data sources.

What’s troubling in these findings is the 24% of respondents who, by their own admission, are not spending enough on their data

management tools and strategies to even cover the basics of data management, followed by 3% who have not even begun to invest in developing a data practice within their organizations.

Given the efficiency and cost savings that are associated with public data, obtaining the means to reliably use it to fill gaps in KYC reporting and due diligence processes makes sense both for those who are looking to continue improving the data practice, as well as those who are beginning to make strategic investments in their capabilities.

Imperatives for the buy side and sell side

1

Sell-side firms need a scalable way to obtain and document trustworthy public data to help support their KYC and other regulatory processes. They should begin to investigate ways to scale up the cost and time savings public data provides within the right solution frameworks.

As the sell side moves to utilize more public data over the course of the next 12 months, they should strive to maximize the advantages that come with broader adoption while accounting for compliance requirements around areas including record retention. With the ability to more effectively integrate public data into due diligence processes, the sell side gains the means to save time and money while mitigating the uncertain aspects of public data usage in its current form.

2

For 82% of the sell side and 68% of the buy side, using public data saves time, money or both.

Despite challenges related to its documentation, public data is a time and money saver for both the sell side and the buy side during their reporting and due diligence processes. This goes far to demonstrate the value of bringing reliable public data sources into KYC processes and due diligence, provided that firms are able to gather the proper provenance information and document it in a reliable and scalable way, which is where the majority have been experiencing challenges. Those who are able to streamline their consumption of public data and organize it in a usable way stand to gain a significant advantage.

3

Ultimately, a collective 73% of all survey respondents are willing to increase their spending to work towards a stronger approach to data management.

Nearly three-quarters of the industry are awake to the fact that investments in data management tools are key to the development of a scalable, holistic approach to KYC and due diligence processes. They require tools that can help build automation into their workflows, draw from high-quality data sources, and bridge gaps in information quickly and seamlessly.

Key Recommendations

- Bloomberg recommends a holistic approach to the development of data management practices based on current and future imperatives around KYC and due diligence reporting processes.

- With significant challenges remaining around streamlining legal entity data overviews, delivering extensive coverage with granular detail, cleansing and using the right data sources, and producing quality analysis, both the buy side and sell side need to develop a single strategy that can deliver in these areas.

- Moving away from highly manual workflows towards efficient processes that take advantage of AI and that deliver diverse and verifiable data, delivering concise reporting, and then creating business-driving insights and stronger client relationships through that data are hallmarks of this holistic strategy.

- When more efficient processes are in place, the ability to bring in a large amount of reliable public data becomes an invaluable supporting capability that allows teams to scale their strategies while promoting cost and time efficiencies.

Appendices

Appendix A: Methodology

The results analyzed in this report were gathered from responses to a benchmarking survey delivered to 279 executives within the FIMA database, representing both buy side and sell side firms. Interviews with sources were conducted after survey data was compiled and centered on discussion of benchmark results.

Appendix B: Demographics

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively.

For more information, visit www.bloomberg.com

Bloomberg’s KYC solutions:

Bloomberg’s KYC solutions provide financial institutions, government entities, insurance companies, corporations, asset managers, asset allocators and their advisors with the tools and services they need to manage risk and safely exchange information with the communities they rely on to do business. These tools help firms move faster, grow key relationships, increase profits while also controlling risk. For more information visit ee.bloomberg.com

Financial Information Management (FIMA), launched in 2005 is the leading data management event for financial services in the United States. Born as a reference data management event, FIMA has quickly grown to cover so much more as different kinds of data are creating new risks to manage and opportunities to capitalize on. Each of our events hosts more than 375 guests from over 145 companies with three days of content and 12 hours of networking. Each year FIMA-hosted sessions and discussions are led by top data management professionals, all covering topics that are of fundamental importance to your enterprise-wide data management initiatives. We’re dedicated to helping you make an ever-increasing impact on your business year after year!

We are a team of writers, researchers, and marketers who are passionate about creating exceptional custom content. WBR Insights connects solution providers to their targeted communities through custom research reports, engaged webinars, and other marketing solutions.

Learn more at www.wbrinsights.com